- HYPER88

- Posts

- The Silent Liquidity Break.

The Silent Liquidity Break.

Repair, Accumulate, and Wait

The last trade war caused a liquidity break in April 2025. The Trade War 1.0 shock created an asymmetric opportunity where market did not know how to price it, causing a nuke across all asset class.

This time, Trump smarten up and didn’t even give the market a chance to react. Trump’s latest tariff move was surgical, executed after market close to avoid visible panic. But while equities escaped the surface damage, crypto didn’t.

Causing a small structural liquidity break in digital assets might be hinting more is to come if feds do not take action fast enough.

1. The Unseen Cascade

The entire crypto derivatives ecosystem cracked open again — not because of macro, but because of collateral structure.

Yield-bearing stables like USDe (Ethena) were being used as collateral across perp markets.

When prices dumped, cross-collateral liquidation loops triggered, magnified by leverage.

Within hours, alts were down 50–80%, and over $1T of notional risk vanished.

Market makers holding BTC and ETH futures took the hit.

Everyone pegged to Binance’s price feed — including on-chain oracles — followed the same death spiral.

This was not just a sell-off. It was a synchronized data cascade.

Open Interest? Gone. All that leverage from April 2025 gone to zero overnight. (Perp Dex meta killed in 6 months)

2. The Institutional Stall

The emotional tone of the market is now exhaustion, not fear.

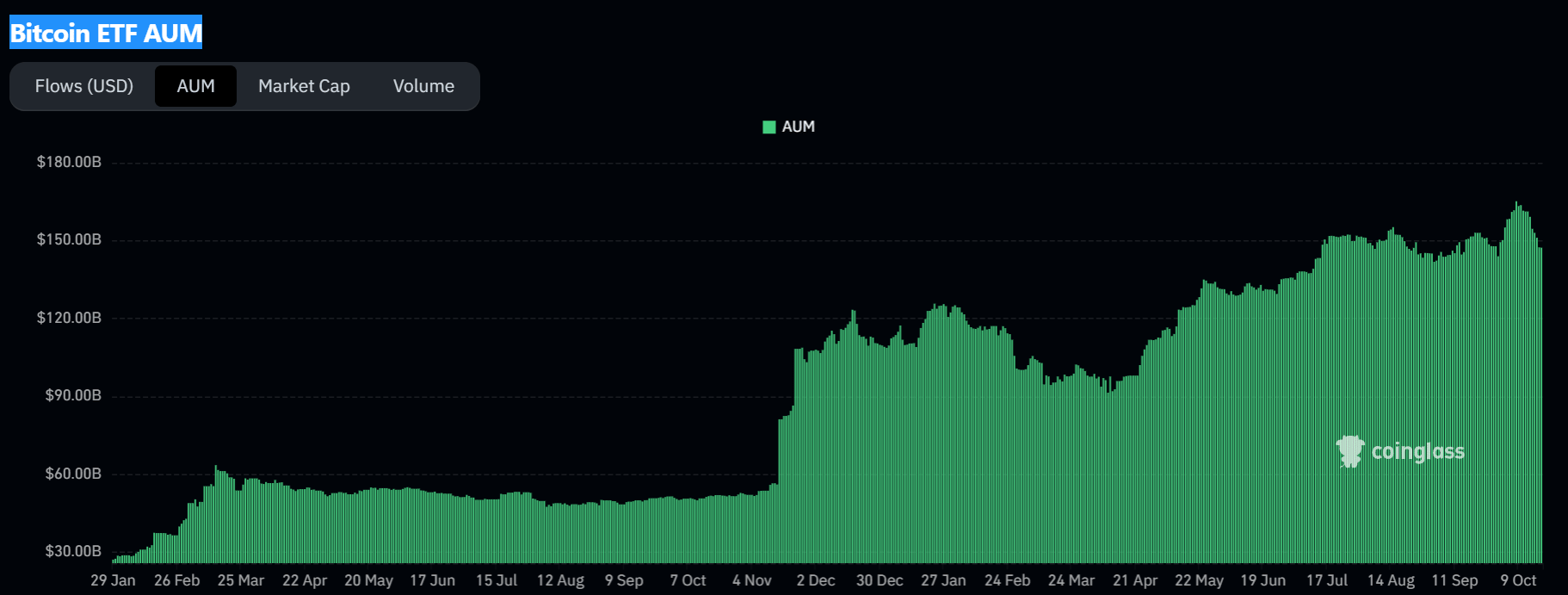

ETF inflows — the one structural buyer left — have stalled.

AUM data shows a flattening just below the peak. Flows haven’t reversed yet, but the bid is gone.

This makes sense:

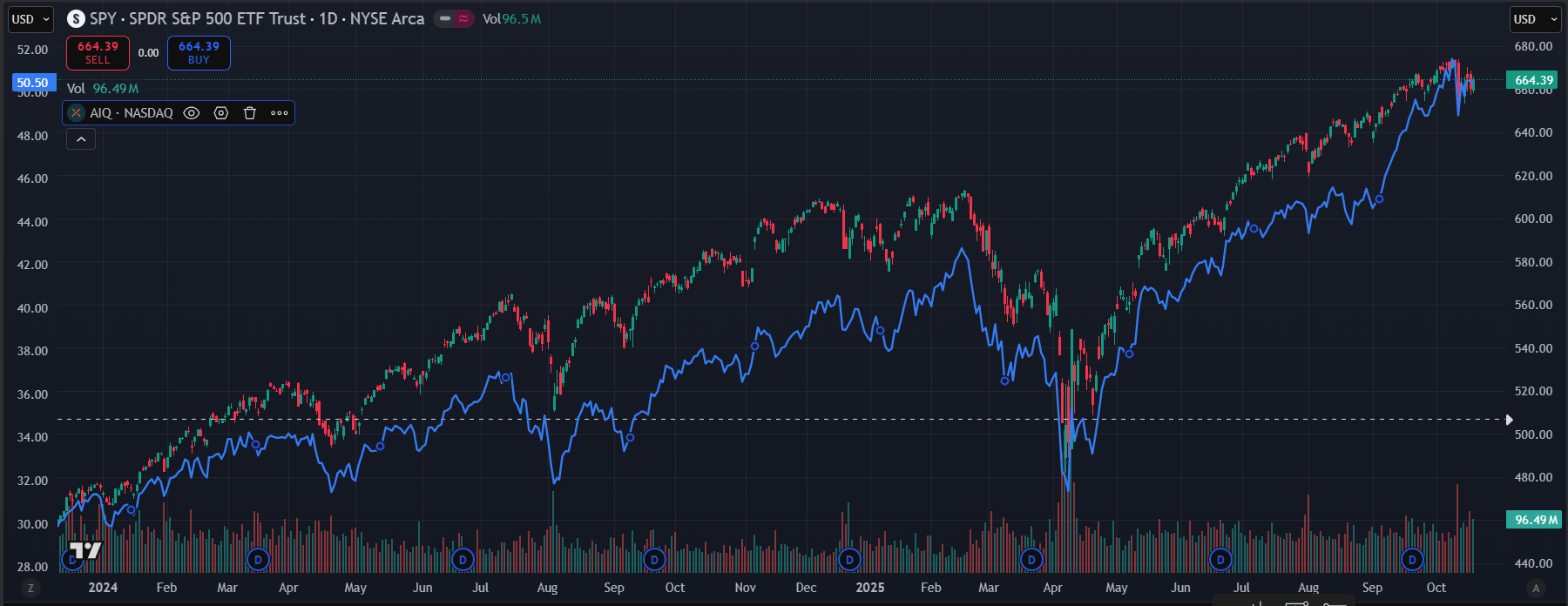

SPY remains near all-time highs; there’s no pressure for rate cuts.

Trump can talk, but he has no monetary tools.

The Fed won’t move until equities bleed 20–30%.

So what we get is a dead market — not crashing, not recovering — just waiting for something to break.

3. AI: The Last Narrative Standing

SPY’s strength is narrow, not broad.

AI is the story holding the U.S. market together — the correlation between SPY and AI ETFs (AIQ, BOTZ) runs near 0.8–0.9.

The smart money is already rotating toward AI dependencies — energy, materials, and compute infrastructure. That’s where the next bottleneck lies.

Everything else is narrative inflation.

Meanwhile, BTC has decoupled, not in strength but in identity.

It’s no longer trading as “digital gold” or “AI’s shadow asset.”

It’s just waiting — post-liquidity, post-leverage, post-story.

4. Signals From Credit and Volatility

Data tells the same story through traditional markets:

SPY near highs, but HYG (junk bonds) underperforms = stress under the hood.

VIX rising despite strong SPY = hedging quietly increasing.

SPY–HYG correlation weakening and SPY–VIX correlation becoming less negative = cracks forming beneath AI euphoria.

This is not risk-on — it’s narrative-on.

5. Stablecoins Are Expanding — But Not Deploying

Despite the crash, stablecoin supply is rising.

That’s not bullish — it’s defensive.

It signals sidelined liquidity, waiting for conviction.

Until open interest rebuilds with clean collateral (USDT/USDC), not synthetic yield products, the system won’t re-lever.

6. Where We Are Now

We’re in a post-liquidity repricing phase:

SPY drifts higher, carried by AI and buybacks.

BTC plans to consolidates between $90K–$110K, waiting for structural flow.

Alts are functionally dead — most are untradeable without leverage.

ETF inflows form a soft floor, not a trend.

Market makers are resetting books, nursing unhedged losses.

This isn’t the start of a new bull cycle — it’s the pause between waves.

7. Forward Triggers to Watch

Trigger | Signal | Interpretation |

|---|---|---|

HYG outperforms SPY (5D–10D) | Credit stabilizing | Risk-on re-entry possible |

VIX back to pre-event range | Vol normalizes | Institutions re-selling vol |

ETF net creations resume | Fresh inflows | Structural bid returns |

OI rebuilds +15–25% with USDT collateral | Leverage returning | Possible BTC breakout |

Stablecoins rise but exchange balances flat | Liquidity parked | No deployment yet |

Until those line up, we’re in equilibrium — a market without a heartbeat.

8. My Take

Every cycle end the Fed policy progresses in the same fashion:

1. We are overheating: hike!

2. Stocks aren’t the economy, stay the course.

3. Stocks Are the economy. We’re watching the market closely.

4. Numbers are mixed: pause and resume.

5. Just one cut.

6. Low for longer.— Alex Gurevich (@agurevich23)

1:39 AM • Feb 22, 2019

It’s liquidity vs structure.

Stay stable and farm yield till year-end.

Market still healing from the USDe collapse — no need to force trades. Park funds in HLP and safe yield farms while volatility stays low. Let others chase narratives.

Wait for BTC to form a clear bottom around the 90–105k range.

Confirmation comes from open interest rebuilding with clean collateral and ETF inflows resuming. Patience beats prediction here.

Expect some volatility around November 12 — likely the shakeout before accumulation.

Stay liquid through it. Post-Christmas into Lunar New Year is the real deployment window, when sidelined capital rotates back.

Load HYPE after the Team unlock.

Let everyone front-run early, then buy when they exit. That supply dump becomes short fuel later.

Patience is alpha.

Rate cut money will take time to flow. Farm through boredom, buy through fear, scale into strength.

Reply