- HYPER88

- Posts

- 2026: The Empty Tank

2026: The Empty Tank

He traded sand for skins, skins for gold, gold for life. In the end, he traded life for sand.

Signal: Bearish / Defensive Accumulation

“He traded sand for skins, skins for gold, gold for life. In the end, he traded life for sand.”

—Afari, Tales

We enter 2026 in a precarious position. The narratives are loud—crypto institutionalization, regulatory clarity, and the "inevitability" of the next leg up. But the data whispers a different story.

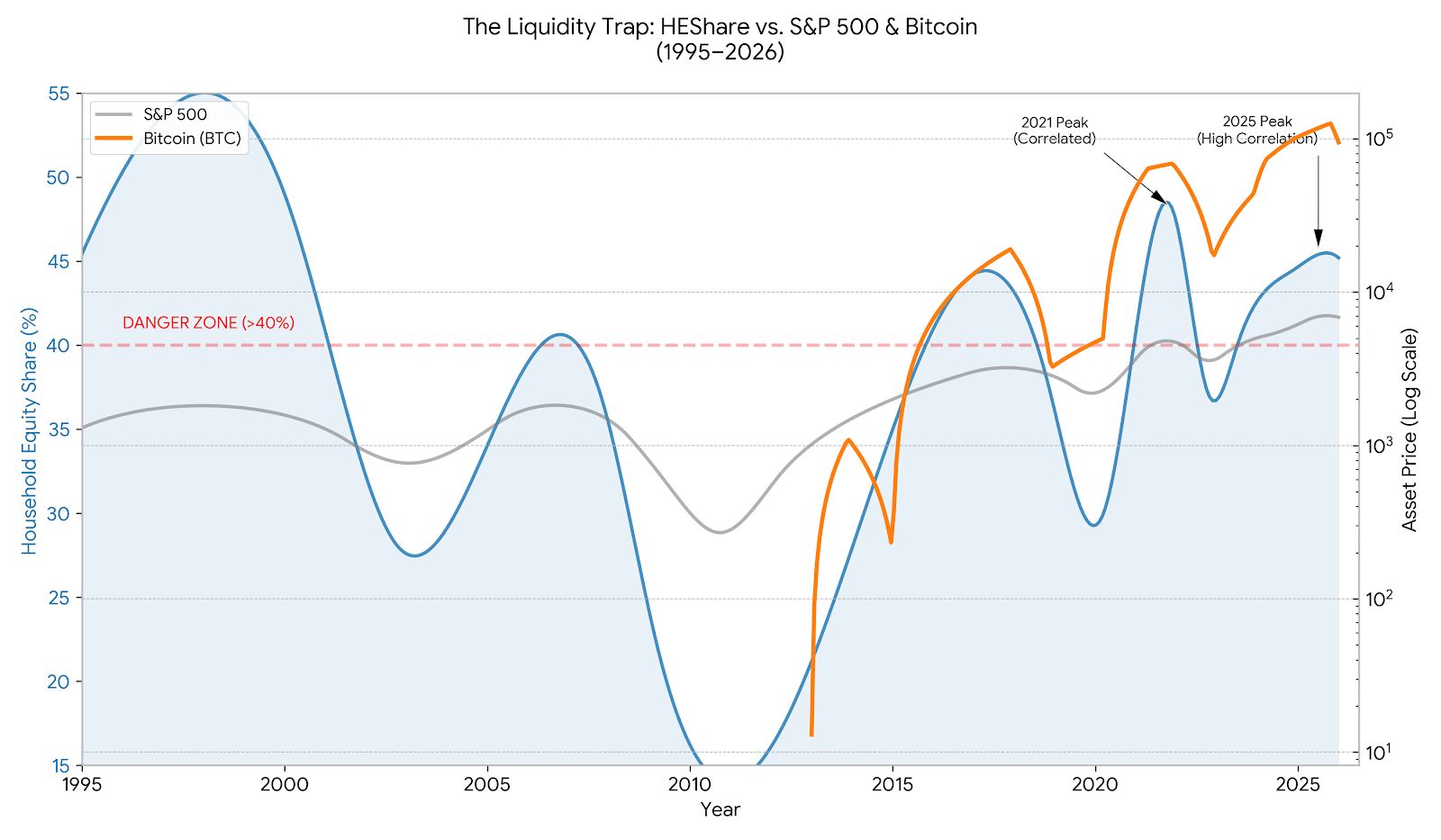

The "Single Best Predictor" of ten-year returns—Household Equity Share (HEShare)—is flashing a warning we haven't seen since 1999 and 2021. The engine of the last bull run (the US Household) is out of fuel.

The Core Thesis: "Greed" has Peaked

Markets are auctions. Prices only go up if there is a buyer with new cash to bid them higher.

Low HEShare (Opportunity): Households hold lots of cash. They are fearful. This is potential energy.

High HEShare (Danger): Households are "all-in." They hold stocks/crypto and very little cash. This is exhausted energy.

As of our last confirmation (Q2 2025 data + market proxies), households have allocated ~45.4% of their financial assets to equities. This is effectively an all-time high.

The implication is simple: There is no "greater fool" left. Everyone who wants to be long is already long.

Other interesting insights: TCG and Collectables are showing signs of slow down growth as people are starting to be rotating between different IPs.

Data: The Danger Zone

Copy this table for your own tracking.

Period | HEShare Level | Market Outcome |

Dot-Com Peak (2000) | 47.6% | -49% Crash (S&P 500) |

Housing Peak (2007) | 37.0% | -57% Crash (GFC) |

Post-COVID (2021) | 48.1% | -25% Bear Market (2022) |

Current (Jan 2026) | ~45.4% | Forecast: Negative Real Returns |

Safe Zone | < 30% | Accumulation Zone |

"A contrarian isn’t one who always objects—that’s a conformist of a different sort. A contrarian reasons independently, from the ground up, and resists pressure to conform."

The Crypto Overlap: Why 2026 is "Winter"

We are currently trading Bitcoin at ~$94,000. The consensus view is that the ETFs will carry us back to the 2025 highs of $126k.

The HEShare model disagrees.

Bitcoin is now a high-beta asset correlated with household liquidity. When households are tapped out (High HEShare), they cannot support risk assets during corrections.

The 2026 Scenario:

The Trap: Early 2026 sees a chop/sideways grind (the "Fake Recovery").

The Flush: A standard equity correction triggers margin calls. Because households have no cash buffers, they are forced to sell liquid winners (BTC) to cover traditional losses.

The Consequence: We retest the "unthinkable" lows.

Bitcoin Cycle vs. HEShare Reality

Metric | 2025 Status (Last Year) | 2026 Outlook (This Year) |

Price Action | Euphoria ($126k Peak) | Hangover / Mean Reversion |

Narrative | "Institutional Adoption" | "Liquidity Crisis" |

Retail Fuel | Empty (Buying the top) | Deleveraging (Forced selling) |

Cycle Phase | Bull Market Peak | Post-Halving Bear Year |

Strategy: The Art of Doing Nothing

In a high HEShare environment, the winning move is capital preservation, not aggressive expansion. We are switching from "Hunter" mode to "Farmer" mode.

"All the returns in life, whether in wealth, relationships, or knowledge, come from compound interest."

Compounding requires you to never get wiped out. 2026 is a "wipe-out" risk year.

The Playbook:

Cash is a Position: Do not view cash as a drag. View it as a call option on future distress.

Reduce Leverage: If the market drops 30%, will you be forced to sell? If yes, you are over-leveraged.

The Buy Zone: We are waiting for HEShare to cool off (below 35%) or for Bitcoin to revisit the $60k–$70k liquidity bands.

Final Thought

The market is currently a crowded room where everyone is standing on their tiptoes trying to see better. No one can get any taller. The HEShare metric tells us we are at maximum stretch.

Be patient. Let the crowd tire themselves out.

"Play long-term games with long-term people."

Reply